eDiscovery Daily Blog

Are We More Confident in eDiscovery Business Than We Were a Year Ago?: eDiscovery Trends

The results are in from the Complex Discovery Winter 2017 eDiscovery Business Confidence Survey, which has just concluded and (as was the case for the 2016 Winter, Spring, Summer and Fall surveys) the results are published on Rob Robinson’s terrific Complex Discovery site. How confident are individuals working in the eDiscovery ecosystem in the business of eDiscovery? Let’s see.

As always, Rob provides a complete breakdown of the latest survey results, which you can check out here. So, to avoid redundancy, I will primarily focus on trends over the past four surveys to see how the responses have varied from quarter to quarter and (for the first time since this is the second year of the quarterly survey) will take a look at a year over year comparison to the Winter 2016 survey.

The Winter 2017 Survey response period was initiated on January 20, and continued until registration of 100 responses on February 6. Rob notes that this limiting of responders to 100 individuals is new with the Winter 2017 survey and is designed to create linearity in the number of responses for each quarterly survey (it also gets rid of those pesky decimal points in the results). This quarter the 100 responses were received at the fastest rate in the history of the survey. So, in the future, if you want your voice heard, respond early!

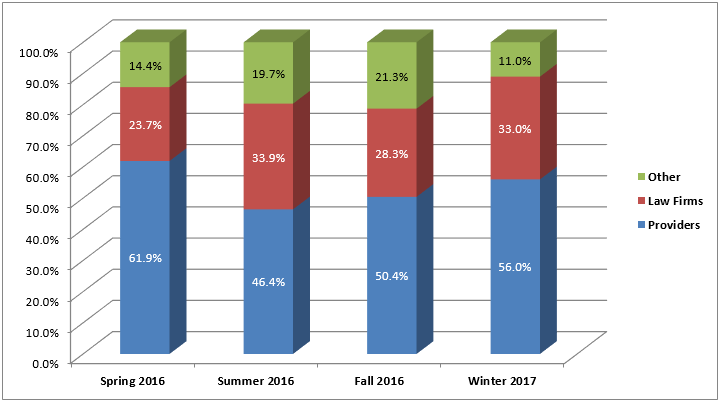

Percentage of Provider Respondents Rising Back Up: Of the types of respondents, 56 out of 100 were either Software and/or Services Provider (40%) or Consultancy (16%) for a total of 56% of respondents as some sort of outsourced provider (over half of total respondents – I’m counting law firm respondents as consumers even though they can also be providers as well). Law firm respondents comprised a majority of the remaining respondents with 33%. No other type of respondents was over 4%. Here’s a graphical representation of the trend over the past four quarters:

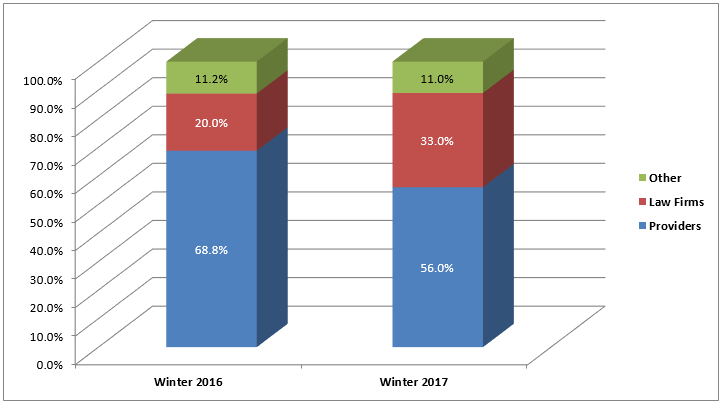

When comparing this year’s Winter survey to last year’s survey, it is clear that (despite the rise in percentage of provider respondents this time), the survey is still more diverse than before, especially with regard to the percentage of law firm respondents:

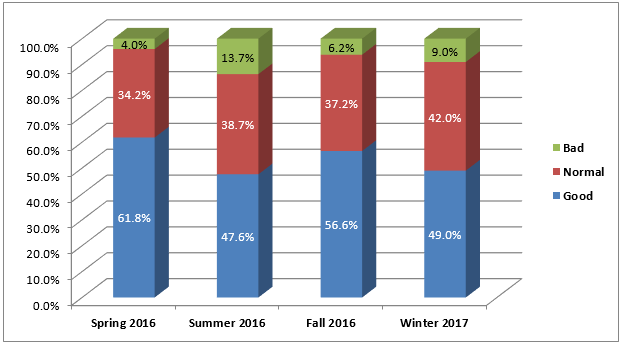

Not Quite Half of Respondents Consider Business to Be Good: Less than half (49%, to be exact) of respondents rated the current general business conditions for eDiscovery in their segment to be good, with 9% rating business conditions as bad. Last quarter, those numbers were 56.6% and 6.2% respectively, so this quarter reflects less bullish than last quarter. Will that trend continue? We’ll see. Here is the trend for the last four quarterly surveys:

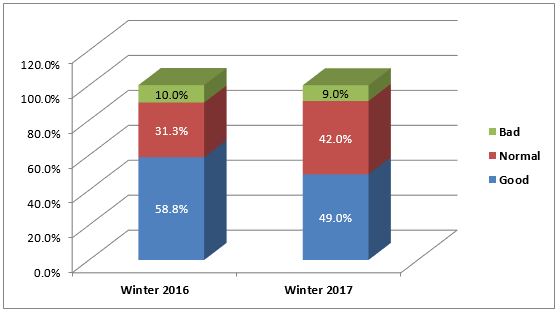

When comparing against last year’s Winter survey, the difference is even more pronounced with nearly a 10% decrease of respondents rating current general business conditions for eDiscovery in their segment to be good:

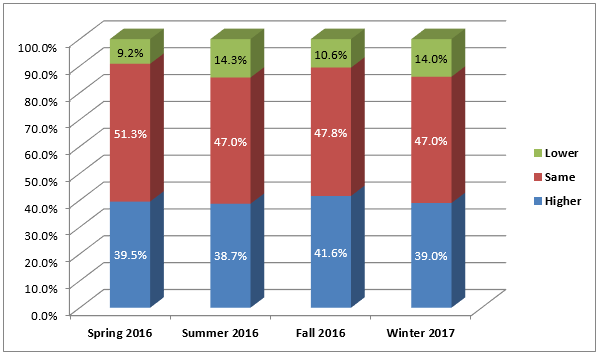

Almost Everyone Still Expects eDiscovery Business Conditions to be as Good or Better Six Months From Now: Almost all respondents (96%) expect business conditions will be in their segment to be the same or better six months from now (slightly above last quarter’s 94.7%), but the percentage expecting business to be better fell to an all-time low of 40%. Revenue (at combined 90% for the same or better) and profit (combined 86%) dropped from last quarter. Here is the profits trend for the last four quarterly surveys:

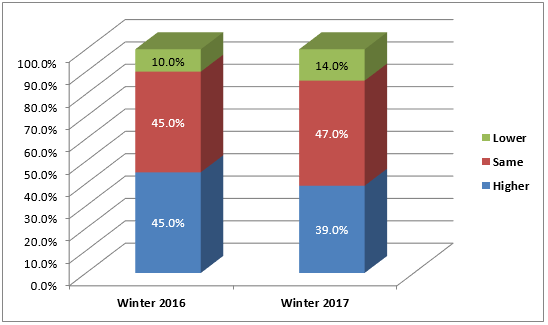

When compared against last year’s Winter survey, the distribution for profits six months from now was less bullish with a 6% decrease of respondents expecting higher profits and a 4% increase of respondents expecting lower profits:

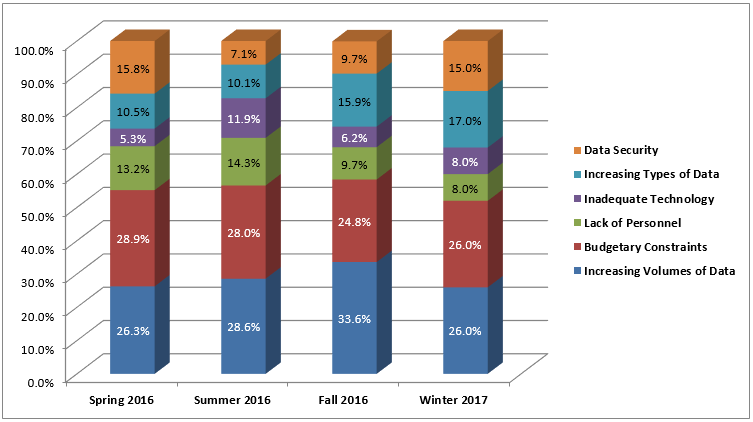

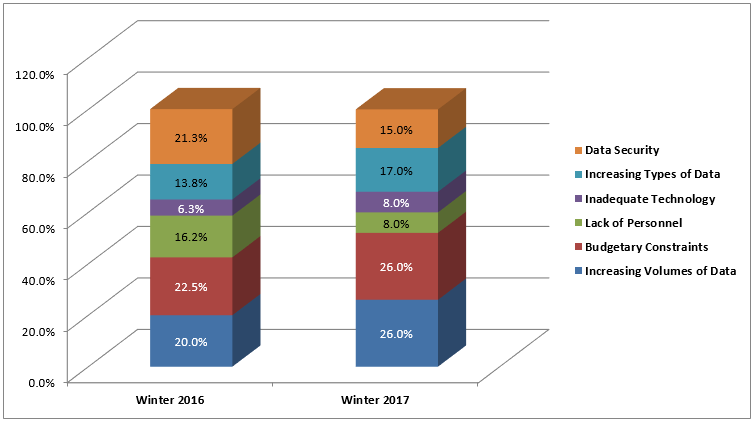

Increasing Volumes of Data and Budgetary Constraints Are Most Impactful to eDiscovery Business: Increasing Volumes of Data and Budgetary Constraints were tied for the top of the most impactful factors to the business of eDiscovery over the next six months at 26% each (perhaps budgeting is more notable during the winter?). Increasing Types of Data (17%) stayed at third, followed by Data Security (15%), with Lack of Personnel and Inadequate Technology (both at 8%) bringing up the rear. The graph below illustrates the distribution across the most recent four quarterly surveys.

A year ago, Budgetary Constraints was voted as the most impactful to eDiscovery business, so maybe there is something to the time of year theory with regard to budget considerations:

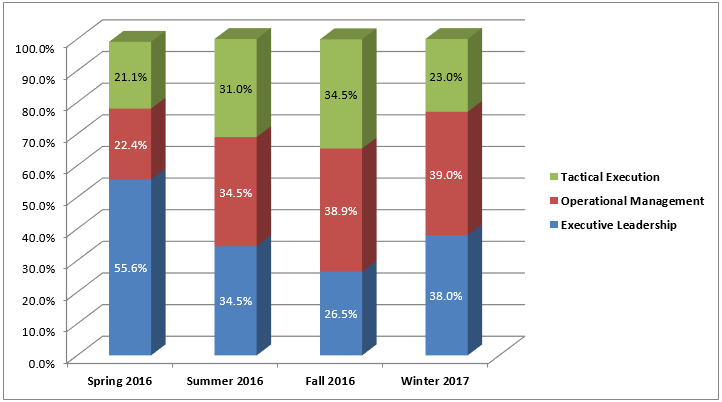

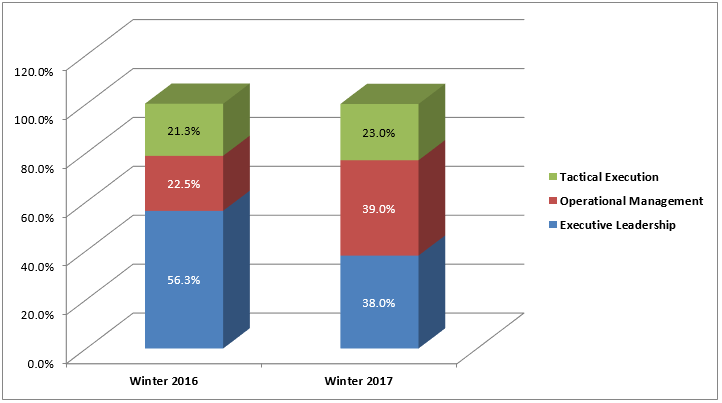

Still a Fairly Even Split Among the Roles: Last time, the “rank and file” dominated the responses with 73.5% of total responses. This time, Executive Leadership respondents rose back up (to 38%), though Operational Management was the leader (at 39%) and Tactical Execution dropped a bit (down to 23%). Here’s the breakdown of the last four quarters:

The survey is certainly more distributed than last year, where Executive Leadership was a clear majority of the responses. Does that mean that the “rank and file” are less bullish than Execs? Or does it mean that eDiscovery professionals in general are less bullish than before? Hmmm…

Again, Rob has published the results on his site here, which shows responses to additional questions not referenced here. Check it out.

So, what do you think? What’s your state of confidence in the business of eDiscovery? Please share any comments you might have or if you’d like to know more about a particular topic.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.